Welcome to Marketing Chronicles. A monthly dose of strategy and creativity for brands, agencies, and businesses — delivered on the second Wednesday of every month. If you like what you see and you’re not already a subscriber, join us for free.

Hello Marketing Chroniclers. In today’s column I’ll be doing another deep dive into a hot category: skincare.

With the rise of celebrity-backed skincare products this category has increasingly gained mental space in pop culture with a projected CAGR of 4.2% through 2030. But today, I’m not here to talk about celebrities – instead I’m peeling back the layers of one of the hottest skincare challenger brands of the moment: The Ordinary.

Enjoy 🧠

COLUMN/

Unlocking The Ordinary’s Next Growth Wave

Founded in 2016 by the Iranian-Canadian Brandon Truaxe, The Ordinary was part of a bigger project of his: DECIEM, also known as the “Abnormal Beauty Company.” The idea behind this venture was to build multiple skincare brands under one roof, controlling formulation, production, and distribution to avoid the opacity and markup prevalent in the beauty industry.

The idea behind The Ordinary was to provide simple, science-driven formulations with transparent ingredient lists, at unexpectedly low prices – and they’ve stayed true to this positioning as per Tracksuit data below. In a category historically known for extremely complex molecule names, elaborate skincare routines, and marketing-induced foggy mirrors, there was a clear need in the market for those who had not invested hundreds of hours researching their optimal combination of products.

The products that helped them breakthrough in the market was their viral hits Niacinamide 10% + Zinc 1% Serum and Hyaluronic Acid 2% + B5. As you can tell, they have attempted to drive credibility within the scientific space by naming their products after the substances themselves – but given how simple their formulations were, it also served as a way to say: “hey, this is all there is in here, no BS.”

However, as the brand grew, this approach alone didn’t seem to give them a leg up in being perceived as a “backed by dermatologists” brand. While the brand scores above the competitor average in perceptions of being easy to shop, affordability, and effectiveness (all very much in line with their positioning), the household names who have been playing this game for longer (such as CeraVe and La Roche-Posay) clearly have a competitive advantage in this critical, and highly competitive, association.

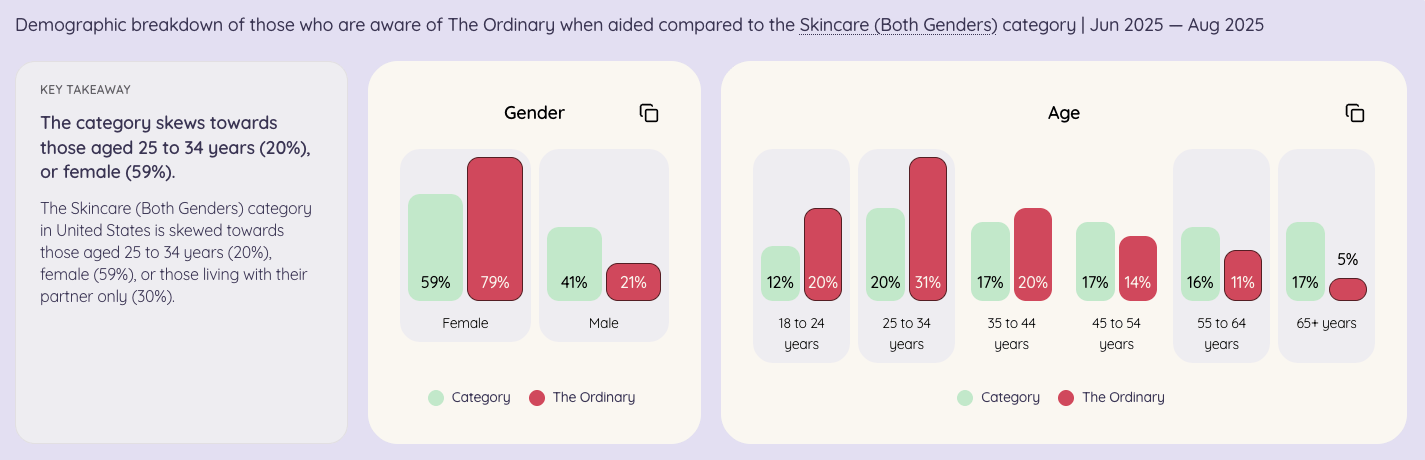

But what’s even more interesting is the demographic opportunity that The Ordinary has. In the U.S. more than half of men (52%) now practice facial skincare – a 68% jump since 2022 – with Gen-Z males at 68% usage. This is a clear structural change taking place in the marketplace that brands are paying attention to (recently brands like Rhode began running targeted ads on Instagram towards men, indicating that others have already picked up on this shift).

Now, when we look at the levels of awareness of The Ordinary among Gen-Zs, the brand is doing spectacularly well. However, they’re significantly under-indexing among men – a clear opportunity in the skincare category at the moment.

Though we’ve started to see some marketing communications from The Ordinary include men, they’re still quite subtle and also in the very early stages of building mental availability with this segment.

Now, The Ordinary has been making some strategic moves to address some of these opportunities. While CeraVe is partnering up with Michael Cera for the Super Bowl, The Ordinary is playing by a scrappier playbook known to challenger brands.

Instead of going all out for Black Friday with steep discounts, The Ordinary instead chose to launch “Slowvember”, an initiative aimed at delivering a month-long, measured and education-first promotion (with 23% discounts) to combat the race to the bottom from Black Friday.

To continue to attract young people into their brand, they’ve launched a back-to-school essentials experiential activation at campuses across the U.S. and Canada.

To continue to reinforce associations around “backed by science”, they have started to publish playful “chem lab” style posts on their socials to showcase how their products are crafted with rigour, while avoiding the “authority overreach” image that skincare companies (and dental brands) often play into.

They have also recently launched their official Amazon Premium Beauty Store, further unlocking distribution with a massive base of Prime members, all the while having nearly 35 The Ordinary branded bricks and mortar stores, and distribution across more than 500 physical locations throughout North America via retailers like Sephora, Ulta Beauty, and Target. In the skincare category, a hybrid approach to physical availability such as this is key to unlocking growth.

While they have a lot of wind in their sails, now is the time to double down and go big.

From Democratizing Skincare to Earning Authority at Scale

So, here’s what we know:

Key Associations: The Ordinary is winning on “affordable” and “effective” associations, particularly among 18–34-year-olds, but authority cues (i.e. “backed by dermatologists”) trail leaders like CeraVe and La Roche-Posay.

Awareness Gap: Unaided awareness has a ton of headroom (currently sitting at 24%) in a massive category (67% of U.S. adults buy skincare).

Structural Shifts: Gender skew is pronounced (79% awareness among women vs 21% among men), all the while the male whitespace in skincare is getting structurally bigger.

This simple diagnosis gives us clues as to where The Ordinary should be investing their budgets into while staying true to their positioning.

For starters, there’s no “hack” to get over this hump. Every challenger brand eventually reaches this point where in order to achieve escape velocity, significant investment into marketing needs to be made (assuming the product is of great quality).

Playing into the “affordable” space can be tricky, because you don’t ever want people to buy you just because you’re cheap. You want your consumers to think of you at key buying occasions (also known as CEPs, category entry points), and in order to do that you must identify which CEPs are the most valuable, underserved, and possibly ownable to you.

Looking at The Ordinary the answer jumps out of the page: an uncomplicated skincare routine.

This CEP perfectly aligns with men’s relationship with their skin. It’s a well-known fact that most guys don’t hydrate their skin, wash their faces with bodywash, and can largely get away with it because of they have less visible skin flare ups than women (due to several reasons such as skin thickness, barrier function, and oil production).

But now that skincare is becoming more top of mind, The Ordinary is perfectly positioned to dominate this segment because of men’s desire for simple and affordable solutions that won’t disrupt their routine all that much.

Showing up during sports commercial breaks on TV is the perfect moment to not only capture Gen-Z males’ attention who are increasingly more attuned to skincare, but also older generations who are still largely unaware of The Ordinary.

Going one step further, and partnering with iconic athletes that embody simplicity (such as Kawhi Leonard, Leo Messi, Roger Federer, Jalen Hurts, etc.) is an excellent way to drive credibility with an audience that follows sports closely all the while inserting themselves into another key CEP for men: post-workout skincare.

Finally, while The Ordinary has had a fantastic strategy around product naming, they need an extra push to breakthrough the below average perceptions of “backed by dermatologists.”

Much of this gap would likely get closed with an increase in brand awareness via mass media, but doing so strategically is key to bring along authoritative associations with you. A few interesting ways in could be:

Running experiential activations alongside brand campaigns with key target audiences where the existing playful “chem-lab” content can come to life through a more derma-centric angle.

Co-creating Derm-Office Hours short videos for social.

Creating a brand visual language system around dermatology that goes beyond typography.

The possibilities are endless.

While The Ordinary’s first decade was about democratizing efficacy, the next chapter is about earning authority signals at scale. The brand is well-positioned to grow its market share among men, all the while driving credibility through its existing brand position that makes science look easy.

More of PPA:

🗣 For speaking engagements, you can reach me at [email protected]

PPA

Pedro Porto Alegre is a seasoned marketing strategist with in-depth experience building brand and communications strategies for top-tier B2C and B2B organizations across North America. His repertoire extends from crafting and executing integrated multi-media brand marketing campaigns to the commercialization of performance-driven innovations for multimillion-dollar and nascent brands alike.