Welcome to Marketing Chronicles. A monthly dose of strategy and creativity for brands, agencies, and businesses — delivered on the second Wednesday of every month. If you like what you see and you’re not already a subscriber, join us for free.

Hello Marketing Chroniclers. This is a special edition of the newsletter when I send out ad-hoc essays that go deeper into a specific topic relevant to our profession.

This week I’m diving into why challenger brands should NOT be emulating the strategies of mature brands — but instead making the necessary moves that are demanded of them for their particular stage of growth.

Enjoy 🧠

COLUMN/

Can We Stop Talking About Apple and Nike, Already?

Markets are dynamic systems.

Ever since mass production of goods found global distribution systems, mass media, and brand management, the consumer economy has effectively developed a life of its own.

Whether you’re selling a bushel of wheat or the latest AI-powered operating system, there’s very little you can do to rein in the markets. Instead, you must learn to swim in its ever-changing waters.

For decades, Nike and Apple have honed this craft – and they’re still at it, working to shape their place in the future.

But today I’m not here to sing their praises. We all know how exceptional these brands are – and truly how abnormal their success has been in a sea of failed brands.

Instead, I want to talk about how challenger brands – those that are still fighting to achieve “escape velocity” – can increase their chances of success.

But first, let’s turn to a time when Nike and Apple were still challenger brands themselves…

Apple & Nike Challenger Days

Apple was founded in the late 70s, when computers were still seen as just business tools.

The big market leaders at the time were IBM, Hawlett-Packard, and mainframe makers like DEC. But the average person didn’t yet own a personal computer – it was still seen a niche, expensive thing to purchase.

Meanwhile Nike, founded in the mid-60s under the name Blue Ribbon Sports, was primarily operating as a Japanese running shoes importer into the United States.

At the time, shoes were still seen mostly as a functional gear for sports, not lifestyle fashion. So, brands like Adidas – with its century-long head start – owned track & field and soccer, while Converse dominated basketball. Jogging was not yet a cultural phenomenon, and “athleisure” was certainly not in the lexicon.

What both pictures have in common can be summarized as follows:

There were 4-5 dominant players in the market

The market itself was defined very narrowly compared to today

Emerging cultural niches were largely being ignored by the market leaders

Sound familiar?

The Product Category Lifecycle (PLC)

All product categories are in a constant state of evolution.

Cultural, political, social, economic, and technological macro forces are constantly shaping our surroundings – sometimes at a glacial pace, and at others at breakneck speed.

Markets are inherently reactive systems – they exist to serve customers by generating added value while extracting a profit in return. But if consumer needs are shaped by the macro forces described above, then brands – which facilitate choice – are derivative entities of such a dynamic system.

This means that no organization can escape what is formally known as the Product Category Lifecycle (PLC for short).

The PLC is split into 4 key stages: product/category introduction, growth, maturity, and decline.

At each stage of the cycle, brands need to be acutely aware of what is demanded of them to succeed.

In the early days of a new product, sales are obviously low, therefore the cost per customer acquisition is still very high (oftentimes, incurring an initial loss to acquire the customer, such as in the case of banking services).

This means that brands are likely not yet turning a profit, and if the category is new (think consumer-facing AI in 2022), there are actually very few competitors.

If you’re introducing a new product into the market, the brand’s objective should be purely to create awareness and trial with consumers labelled as “innovators”. These folks are often at the peripheries of culture, always searching for the latest tech, product, or solution to very unique problems.

The realities of this stage are rough – most brands focused on technological innovation fail here as they run out of cash to drive consumer trial. Others, focused on catering to an underserved sub-category, and therefore originate from a more consumer-centric place, tend to have slightly higher chances of success.

As the brand acquires more customers, it will eventually enter the growth stage. Think of scale-ups at this point – large sums of money are being spent to gain market share, and if the category is new, it becomes all about the first-mover advantage.

During this stage, if brands have done a good enough job driving awareness and trial in the recent months/years, sales start to increase rapidly as early adopters begin to gather evidence that the brand can be trusted. Here it’s all about maximizing market share, as chances are you’ll be going up against more competitors who have been in this journey for longer than you.

For the first time in the brand’s life, it may start turning a profit.

This is where challenger brands often find themselves.

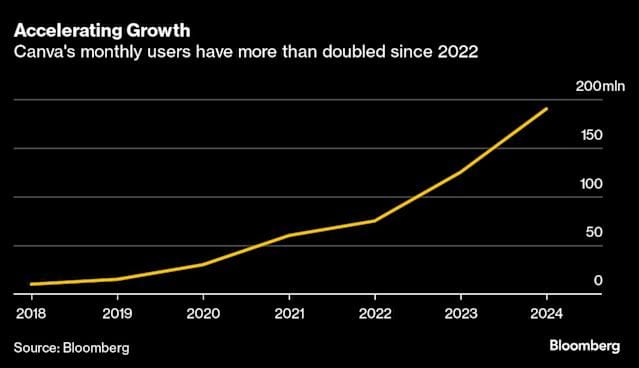

Canva is a great example of a challenger brand that was able to achieve “escape velocity” nearly 10 years after its founding (2013).

As brands grow and achieve maturity, the early and late majorities start to try their products and sales eventually peak. Cost per acquisition is at its lowest due to economies of scale, and profit starts to taper off as category norms establish themselves in the minds of consumers, and at times pricing tiers become self-evident. Therefore, at this stage it’s all about maximizing absolute profits and defending market share.

This is where Apple and Nike find themselves today.

Most competitors will have either been acquired or failed by this point, so if you’re lucky you might be running an independent brand that warrants respect from major players. Unless you plan on achieving world domination, an exit strategy should be in your horizon. And by that, I mean, being acquired by a larger business, or risking running a lifestyle business until an eventual decline in sales (at which point there will be far less money to be made from the sale of the business).

Nike’s market share has remained relatively stable (42% - 47%) over the years with most of the fluctuations in share of market happening amongst challenger brands.

All good things come to an end. Some brands can sustain product maturity for longer than others if they have deep pockets (think Coca-Cola). But the reality for most is that sales will eventually start to decline and, even though cost per acquisition remains low, the game becomes all about reducing expenses and milking your brands for as long as you can.

The Challenger Brand Reality

As I mentioned above, challenger brands often find themselves in the growth stage – meaning, they’re laser focused on gaining market share.

This objective leads us to some inevitable conclusions about the marketing mix:

Product

While you may have gotten here with a single core offering, expanding the product mix into new segments, service add-ons, and adjacent solutions will be key to increasing your customer base.

Price

While pricing strategy varies by brand positioning, the goal here is about setting a price that facilitates market penetration. Whether that is accepting lower margins to broaden your base or adopting a pricing architecture that protects the premium offering while launching an affordable sub-brand that serves a lower pricing tier, those are key strategic choices that need to be made to acquire more customers.

Place

While in the early days you may have been selling your product direct-to-consumer to minimize margin erosion, at this stage you need to start thinking bigger. If you’re a product, devising a retailer strategy will be imperative to drive market penetration; if you’re a service, thinking through your partnerships, events, and search strategies are all ways to expand your presence.

Promotion

While in the introduction stage you’re driving awareness and trial with innovators or smaller sub-segments of the market, at this stage you need to think mass market. Advertising now needs to go beyond smaller tactical plays, and into bigger buys that maximize reach in a more cost-effective way (like Television).

Discounting

While in the early days you may have been offering steep discounts to drive trial, at this stage you need to rein that in due to increased demand and so you can begin turning a profit. Remember, discounting erodes brand equity – so, use it selectively and wisely!

This presents a contrasting strategy when compared to mature brands like Nike and Apple:

Growth Stage | Mature Stage |

Maximize market share | Defend market share |

Enhance product offering | Diversify product mix |

Price for market penetration | Price to match competition |

Expand distribution | Expand distribution even further |

Build awareness with mass market | Strengthen existing CEPs and expand into new ones |

Reduce discounting due to growing demand | Increase discounting to prompt switching |

Lululemon, The Challenger

To this day, the ascent of Lululemon remains a masterclass in a challenger brand strategy well-executed. While a market leader today, there’s a lot to be learned by looking back at how they got here.

Since its early days in Vancouver, Canada in the 90s, Lululemon has remained laser focused on executing a challenger strategy centered around:

Serving their tribe (modern yoga practitioners)

Owning the point of sale (expanding store locations)

Building core products with technical credibility (Luon, a proprietary blend of nylon and Lycra®)

Pricing architecture composed of premium core products and accessible accessories (from $350 jackets to $14 headbands)

Ambassadorship strategy to entrench itself as the brand synonymous with yoga and athleisure (from sponsoring local instructors and studios to offering trade-in programs)

Lululemon’s first store in Vancouver, Canada (1998). This would turn out to be a crucial challenger tactic to drive physical availability and word of mouth.

Much how like when Nike and Apple entered the game, Lululemon was also going up against established sports apparel market leaders – namely Adidas and Nike themselves.

But instead of trying to slay a giant, Lululemon identified an underserved segment of the market that mature brands had largely overlooked up to that point – yoga practitioners.

They went on to narrowly focus on women’s yoga bottoms at the start, and as they gained market share within that sub-category, started expanding into others – like men’s apparel, shoes, shirts, and more.

Their pricing strategy was also very much in-line with their high-quality positioning. Premium price-point with no discounting or sales, but with accessory launches that gave anyone access to owning a Lululemon piece.

Since they were laser-focused on owning the yoga sub-category, they focused on establishing partnerships with local studios, sponsoring yoga teachers, and launching bricks and mortar stores in key hip locations. This not only expanded their physical availability into the nooks and crannies of the yoga market that Nike and Adidas were too big to care for, but also served as a form of advertising that relied on word-of-mouth.

Fast-forward to today, as they expanded into most athletic apparel sub-categories, they struck a sponsorship deal with Team Canada for the 2024 Paris Olympics, effectively scaling up their reach across all sports.

After years of being narrowly focused on yoga, Lululemon kept expanding into other sub-categories within the sports apparel market, and cemented itself as a mature brand when they became Team Canada’s official partner for the Paris Olympics in 2024.

As we can learn from this challenger strategy, competing against deep-pocketed market leaders isn’t a game that can be won in hand-to-hand combat — you must find backdoors into the category that establish your brand as a trusted member of a sub-segment before expanding into bigger turfs (unless, of course, you have deep-pocketed investors backing up your new brand, which is what often happens inside market-leaders’ organizations – they develop and launch innovations effectively zipping through the initial stages of the PLC quickly and efficiently).

Finding these underserved segments isn’t rocket science. The real challenge is cutting through assumptions about who your buyers are and where they spend their time. Too often, brands either chase mass attention or double down on hunches — and both can be expensive mistakes.

This is where tools like Tracksuit come in. With their new Category Profile and Media Consumption dashboards, challenger brands can see the category as it really is:

Who actually makes up your potential buyers (by age, gender, income, and region).

Where those buyers are spending their time, from TikTok to TV.

And the blind spots your competitors — even category leaders — are failing to serve.

For a challenger, that kind of clarity is a competitive advantage. It’s how you uncover niches that the big players ignore, sharpen your positioning, and choose your battles with precision. It’s also the kind of data that helps leadership teams make bold decisions with confidence, instead of guesswork.

If you want a closer look at how today’s challengers are finding their edge, Tracksuit has pulled together seven Category Challengers reports — spanning high-growth spaces from skincare to running shoes — packed with category-level data and case studies from real underdog brands.

Today’s Challengers, Tomorrow’s Market Leaders

Though brands like Apple and Nike are rightfully discussed in marketing textbooks, they have very little in common with challenger brands.

In their current state, they’re defending market share, speaking to mass markets, and diversifying their offerings in an attempt to uncover untapped revenue.

Growth for them oftentimes come from geographical expansions (think when Apple opened their first Apple Store in China), and mergers and acquisitions (think when Nike bought Converse).

Organic growth is incredibly difficult for mature brands, which is why they typically only target 3%-5% growth every year through a mix of price increases, limited time offer innovations, and discounting to steal customers from competitors.

They can do that because most successful mature brands have cash cow businesses – like Apple’s locked-in upgrade cycle of the iPhone, and Nike’s apparel basics that are always in demand.

Challenger brands, on the other hand, have not yet achieved such a cruising altitude. Scaling up is resource intensive and requires different tools and mechanisms to achieve growth.

It’s not satisfactory as a challenger brand to grow 3%-5% per year. Growth often needs to break the double digits. It’s risky to discount a brand that’s still building equity in the minds of consumers because it might entrench a poor-quality perception difficult to climb out of. It’s also not wise to offer mark downs when the brand is growing behind organic consumer demand. And though it might be tempting to diversify the portfolio into new categories, challenger brands need to remain focused on enhancing offerings in the game they’re playing today.

Ultimately, while market leaders might be seen as the “shiny city on a hill”, what we can learn from them doesn’t lie on the battles they’re fighting to remain on top – but instead, the bold moves they made as challengers to dethrone the leaders of their time.

More of PPA:

🗣 For speaking engagements, you can reach me at [email protected]

PPA

Pedro Porto Alegre is a seasoned marketing strategist with in-depth experience building brand and communications strategies for top-tier B2C and B2B organizations across North America. His repertoire extends from crafting and executing integrated multi-media brand marketing campaigns to the commercialization of performance-driven innovations for multimillion-dollar and nascent brands alike.