Welcome to Marketing Chronicles. A newsletter where marketers come for expert industry commentary at the intersection of strategy and creativity — every Wednesday sent before daybreak. If you like what you see, join us for free.

In this edition:

Column: How To Approach Marketing Research

Inspiration: John Deere’s “Chief Tractor Officer”

Column: How To Approach Marketing Research

The topic of marketing research can be a contentious one.

Most of the time not enough is invested into this thankless part of strategic planning, and yet it’s the most crucial step into building marketing plans that will actually work.

There are likely a thousand factors into why research is often underinvested in, but a major one that I often see is marketers starting from a product, sales or advertising -centric standpoint.

As I discussed on last week’s column, being market oriented, or in other words “consumer-centric”, is the FIRST step a marketer needs to take in order to do their jobs well.

If we start from a place of “how might I educate my audience on how great my product is”, or “how might I give my sales team as many leads as possible”, or even “how might I craft an award-winning campaign”, we’re missing the point completely.

The underpinning concept of being market-oriented is that we are not the customer, therefore we’re in the dark as to what actually matters to them and how many of those people are out there.

And that’s why marketing research is what follows once we accept our ignorance: we must go find the answers to our questions.

Qual vs Quant

Most of the time we must start our research journey at… you guessed it, Google.

There’s no shame in that. As a matter of fact starting there can save you tons of time and money because in all likelihood you’ll be able to answer several low-hanging fruit questions right off the bat (what’s the size of my market, what trends are shaping my industry, what are my competitors doing, and so on).

But the issue is that most of the time marketers stop there. And sadly, that just doesn’t cut it.

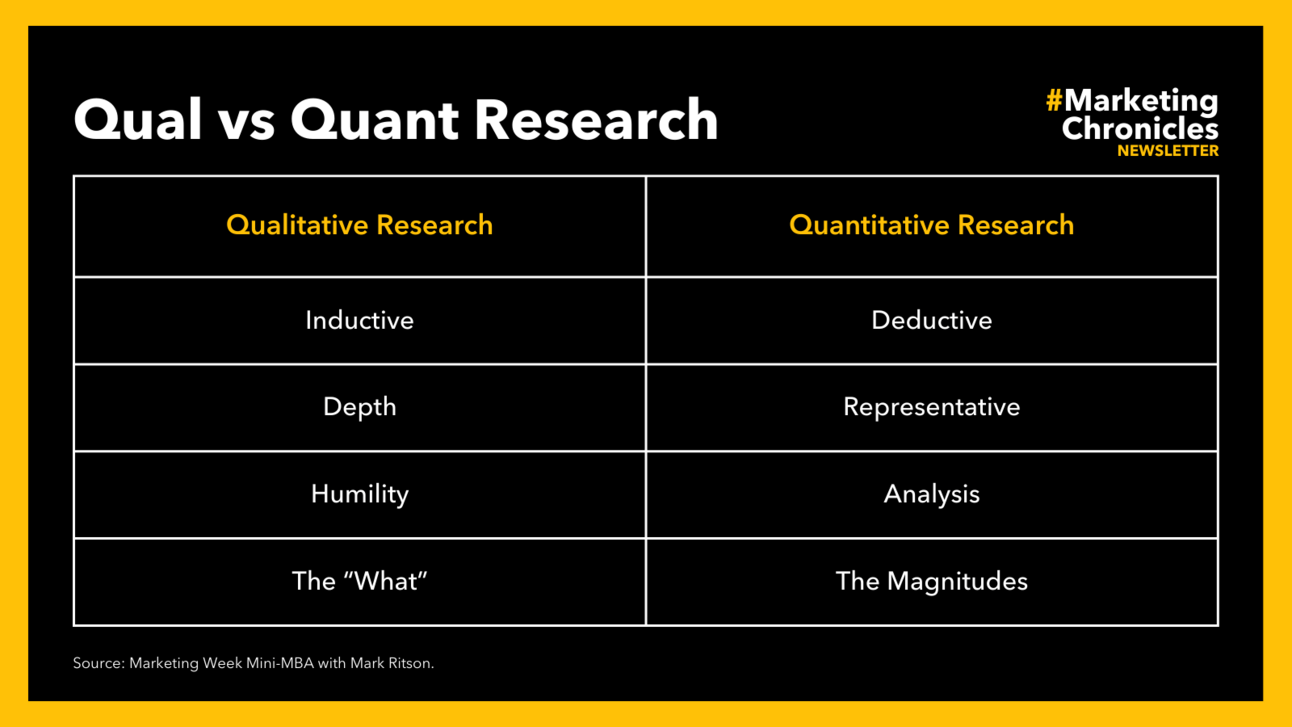

There are two major types of research marketers must understand how to do: qualitative research and quantitative research (qual vs quant for short).

Once you have a basic grasp of you market through your secondary research on Google you can then begin formulating a mental map of what you’re up against — what do I know vs what do I still need to learn.

But don’t be too quick to answering that, instead go out into the field and talk to some customers, get an idea of what’s in their minds, what matters to them, why they are choosing product X over Y, how do they go about selecting brand A over brand B, and so on.

While this ethnographic information won’t be substantive enough to yield actual actionable insights, it’s a fantastic place to start because now you’re beginning to separate the wheat from the chaff.

These deep yet unrepresentative pieces of information will be great qualitative data points to feed into what should follow next: a quantitative survey (or some other quant instrument).

Most often than not surveys are poorly designed (even by survey companies themselves). They’re typically too directional, questions are poorly worded, false assumptions are made about what matters vs not, and they run way too long.

And so, one way to mitigate most of that is to:

Collect as much information as possible from public online sources so that you don’t waste your survey respondents’ precious time and attention spans on things you could find out yourself;

Use the learnings from your ethnographic research to craft more intentional and likely relevant questions that you’re looking to validate at a greater scale, and;

Use plain and conversational English to craft great questions that the respondent will feel like a human actually wrote it and not some machine.

In other words, qual instructs quant by taking the deep insights from in-person conversations and applying to a representative sample (likely in the low hundreds) in order to find out what’s worth pursuing.

But it all starts with the basic assumption that you don’t know anything and you’ll use your precious resources to get a good grasp of your market and audience.

Backwards Research

The list of primary research methods runs in the hundreds. Some of the most popular ones among marketers typically are: focus groups, ethnography, surveys, conjoint, social listening, etc.

Picking which ones are right for you is not only imperative to get the answers you need, but also to keep you within budget. Research can be quite expensive when done aimlessly.

Which is why the concept of “Backwards Research”, coined by Alan Andreasen in the 80s, is such an important one to grasp.

The whole premise of this approach is to start with the decisions you need to make and then work backwards to determine what information is needed to make those decisions effectively. It's the opposite of the more traditional research approach that might start with gathering a lot of general information and then trying to figure out how it applies to specific decisions.

This approach prevents you from spinning your wheels on what type of qualitative research you might need (focus groups, ethnography, deprivation research, etc.) before feeding that into quantitative methods, such as surveys.

So, how do you do it? Simple:

Open your PowerPoint and write the following title on a blank slide: Findings. How will this research be used to make strategic choices?

Then begin working backwards: identify the key questions you need to answer to eventually get to that final point.

Describe each slide with the data points necessary to answer each question. You can go even further and begin planting slides on how slide #3 will be used with slide #10 to give you the answer for slide #15. This is skeleton analytics at its finest.

From there now you have a skeleton deck that will inform your research questions. Design your questions like a human (don’t be too technical, remember customers don’t see your brand or category like you do) and run the research.

Once the results come back, plug them into your skeleton deck, and if you’ve done the “skeleton analytics” exercise mentioned above beforehand, this will be an even easier exercise.

Now take that presentation to your CMO and watch your brand budget grow.

You Don’t Need To Be A Statistician

Sure, understanding statistics is always a bonus, but most marketers are not extensively trained in it.

There are dozens of great research companies out there that can run and create the actual research instruments for you, and in some cases even provide you with the analysis as well. But always make sure to do the backwards research process yourself and craft the questions yourself.

That is because as marketers we have a special gift: we live at the intersection of data and the humanities. We understand numbers but we are also good at contextualizing them.

We make data informed decisions, but need to create plans that will make people move.

This unique set of skills is not easily found elsewhere in the organization.

Lean into it. Accept that you’re not the customer, lead with curiosity, and conduct great marketing research to inform your plans.

Inspiration: John Deere’s “Chief Tractor Officer”

It’s not often that you see major ag businesses that sells primarily to other businesses being this bold.

In an attempt to talk to a younger farming audience, John Deere is on the hunt to find their first ever Chief Tractor Officer (they will pay them a $200,000/yr salary).

They hired some great celebrities — such as the San Francisco 49ers QB Brock Purdy and Indiana Pacer’s PG Tyrese Haliburton — as well as some smaller influencers that likely over-index in affinity in their industry (such as the “Corn Kid” and the “Millennial Farmer”).

This is bold and innovative for an industry that is looking to find its footing with a younger and largely decreasing generation of future farmers.

📢 Community Shout Out

Interested in more marketing and advertising content or have unanswered questions? All you have to do is the following:

Share this week’s newsletter on LinkedIn.

Write something nice about it and add a question.

Tag me on LinkedIn so I can see it.

I’ll answer it in the post comments and pick someone to give a shout out in my next column!

Upcoming: Unlocking the Future of Customer Acquisition

May 16 @ 4:30 pm - 7:00 pm MDT

Earl Grey Golf Club - 6540 20 St SW, Calgary, AB T3E 5L2 Canada

REGISTER HERE

In an era where the landscape of customer acquisition is ever changing, staying ahead of the curve is not just beneficial; it’s essential for any marketer looking to make a significant impact. This exclusive Panel & Power Hour session brings together a trio of local marketers (including yours truly), each with a distinct set of experiences and insights into the dynamics of customer acquisition in today’s marketing world.

What You Will Learn:

Emerging Trends: Uncover the latest trends in customer acquisition, from technological advancements to shifts in consumer behaviour.

Strategic Insights: Gain valuable insights into developing and implementing strategies that resonate with today’s consumers.

Real-World Applications: Learn from the firsthand experiences of the panelists, who have successfully navigated the challenges of marketing in various industries.

Interactive Q&A: Engage with our experts in a dynamic Q&A session, where you can seek advice, clarification, and deeper understanding of the discussed topics.

Whether you want to refine your strategy, explore new avenues for growth, or simply stay informed on the latest customer acquisition trends, we designed this Panel & Power Hour for you.

REGISTER HERE.

May 16 @ 4:30 pm - 7:00 pm MDT

Earl Grey Golf Club - 6540 20 St SW, Calgary, AB T3E 5L2 Canada

More of PPA:

💌 In case you missed it:

PPA

Pedro Porto Alegre is a seasoned marketing professional with in-depth experience building brand and communications strategies for top-tier B2C and B2B organizations across Canada. His repertoire extends from crafting and executing integrated multi-media brand marketing campaigns to the commercialization of performance-driven innovations for multimillion-dollar and nascent brands alike.